Perth Home Loans

Thinking About Buying a House?

Have you consulted with a broker yet? Even if you’re just beginning your home-buying journey, it’s crucial to discuss your options with a broker.

At Wolf Finance, we leverage our extensive industry knowledge to champion your best interests, ensuring the entire process is streamlined from start to finish. Our goal is not only to secure a loan that fits your unique needs but also to shield you from any potential pitfalls along the way. We’re here to simplify your experience and guarantee swift results.

Why Choose Wolf Finance as Your Mortgage Broker?

A mortgage broker serves as your advocate in the home loan market. Whether you’re purchasing your first home or expanding your investment property portfolio, we have access to hundreds of loans from leading lenders across Australia.

We take on the legwork for you, ensuring that you receive the best home loan tailored to your circumstances and oversee the process from beginning to end.

When to Consult Us and What to Expect?

You can consult us at any point in your financial journey. Whether you’re saving for your first home, considering using equity from your existing property, or evaluating if your current loan is still competitive, we’re here to help. Schedule a no-obligation appointment with us at your convenience.

Benefits of Using a Broker:

Access to a broader range of investment opportunities: Brokers have access to a wide array of investment options, including stocks, bonds, mutual funds, and ETFs, which might not be directly accessible on your own.

Expertise and guidance: Benefit from expert insights on investment decisions, market trends, and effective risk management strategies.

Convenience: Save time and effort. Let us handle the research and management of your investment transactions.

Cost-effective solutions: Enjoy potentially lower transaction fees through a broker, leading to cost savings.

Specialised services: Some brokers, like those at Wolf Finance, offer specialised services including retirement planning, tax strategies, and estate planning, adding significant value to your investment portfolio.

For expert guidance and a personalised approach to your mortgage needs in Perth, contact Stephanie Wolfgram at Wolf Finance. Let us help you navigate your home-buying journey with confidence.

Receive Home Loan Assistance with Stephanie Wolfgram

Purchasing a Home, Seeking Guidance, Exploring Loan Options, Pre-Approval, or Loan Applications?

We’ll Simplify the Process for You

Our Loan Assistance Process in Perth

Understanding Your Needs

I start by getting to know you—your financial goals, lifestyle, and property aspirations. This helps me tailor the right loan options for your situation.

Finding the Best Loan for You

With a clear understanding of your needs, I’ll compare lenders and recommend loan options that align with your budget and future plans.

Presenting Your Loan Options

I’ll walk you through the best loan solutions, explaining the pros and cons of each so you can make an informed decision with confidence.

Managing Your Application

Once you’re ready to proceed, Wolf Finance will handle the entire application process, ensuring everything is submitted correctly and on time.

Loan Approval & Follow-Up

I’ll stay on top of your application, liaise with lenders, and keep you updated every step of the way to ensure a smooth approval process.

Settlement & Beyond

Congratulations! Once your loan is approved and settled, I’ll continue to support you with any questions, loan reviews, or future refinancing needs

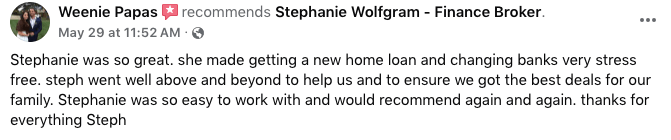

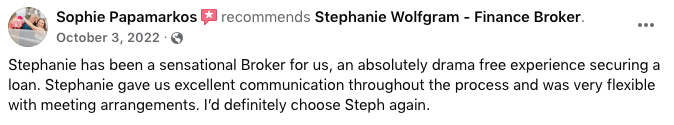

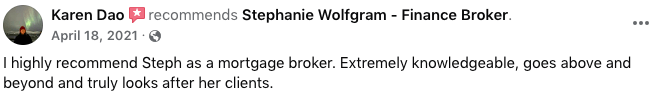

Need a Home Loan? What Our Fabulous Clients Think About Us!

Samantha Buck

Matthew Walsh

Sophie Papamarkos

Jess McCormack

Darryl Johnson

Tessa Lim Tayag

Susie D Wells

Bronte Holmes

Annabel Katherine

Wayne Curtis

Irvin Calica

Karen Dao

Kellie Mansfield

Curtis Vittorangeli

Jo Marie Minney

Kyle Spyrides

Sharon Gleeson

Samantha Dunn