Looking for Advice from Our Perth Mortgage Experts?

New Home Mortgage Broker Perth

Building a New Home? Let Wolf Finance Guide You to the Right Construction Loan

Ever wondered what distinguishes a construction loan for a new build from a traditional mortgage for an existing property? There are several key differences that might surprise you.

Investing in a New Property

Investing in new construction comes with considerable benefits. For one, the depreciation of the building can be claimed as a tax deduction, potentially reducing your taxable income. Additionally, new properties often have lower maintenance costs compared to older buildings. Tenants may prefer newer spaces and could be willing to pay higher rents for the privilege of living in a modern environment. If you’re considering entering the real estate market, a new build offers attractive prospects.

Financing Your New Build

Financing the construction of a new home can differ from buying an existing one. To streamline the process, you might consider obtaining two separate loans: one for purchasing the land and another for the construction phase. Some lenders also offer comprehensive packages that combine these loans for convenience. It’s advisable to consult with a finance broker like Wolf Finance, who can offer customised loan solutions to fit your specific needs and ensure you are well-prepared for the building phase.

Additionally, it’s a good idea to speak with a tax professional. This is particularly important as there may not be any rental income during the construction phase, which could impact your cash flow if not properly planned.

Taking these steps can pave the way for a successful investment and help you secure the home you truly desire.

Contact Stephanie Wolfgram at Wolf Finance to explore your construction loan options and ensure your building venture in Perth is supported by expert financial advice.

Investing in an Established Property

Purchasing a property that’s already constructed offers several advantages, including the elimination of the uncertainties and stress often associated with building a new one. Additionally, the ability to generate rental income immediately can have a positive effect on your cash flow. Given the diversity of available properties, it’s important to take time to determine which type best fits your needs.

The market for new home sales is experiencing a resurgence, driven by both investors and owner-occupiers. The allure of buying off the plan is straightforward – place a small deposit (typically 10%) on the development and pay the rest upon completion of construction.

With ongoing rises in property prices, cities and coveted vacation spots are witnessing a boom in apartment developments. This trend offers potential buyers the chance to experience significant capital growth when they take possession of their new homes. Dive into the market and secure your financial future by considering an off-the-plan investment.

For personalised advice and to explore the best options for property investment in Perth, contact Stephanie Wolfgram at Wolf Finance. Let us help you make an informed decision that aligns with your financial goals.

Receive Home Loan Assistance with Stephanie Wolfgram

Purchasing a Home, Seeking Guidance, Exploring Loan Options, Pre-Approval, or Loan Applications?

We’ll Simplify the Process for You

Our Loan Assistance Process in Perth

Understanding Your Needs

I start by getting to know you—your financial goals, lifestyle, and property aspirations. This helps me tailor the right loan options for your situation.

Finding the Best Loan for You

With a clear understanding of your needs, I’ll compare lenders and recommend loan options that align with your budget and future plans.

Presenting Your Loan Options

I’ll walk you through the best loan solutions, explaining the pros and cons of each so you can make an informed decision with confidence.

Managing Your Application

Once you’re ready to proceed, Wolf Finance will handle the entire application process, ensuring everything is submitted correctly and on time.

Loan Approval & Follow-Up

I’ll stay on top of your application, liaise with lenders, and keep you updated every step of the way to ensure a smooth approval process.

Settlement & Beyond

Congratulations! Once your loan is approved and settled, I’ll continue to support you with any questions, loan reviews, or future refinancing needs

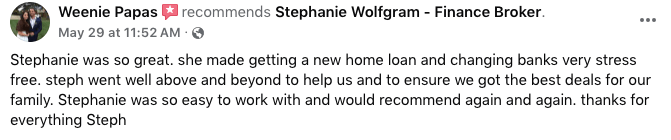

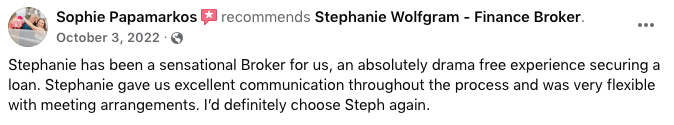

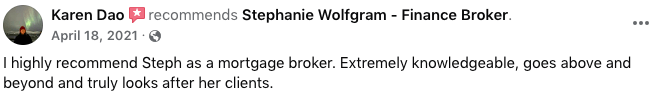

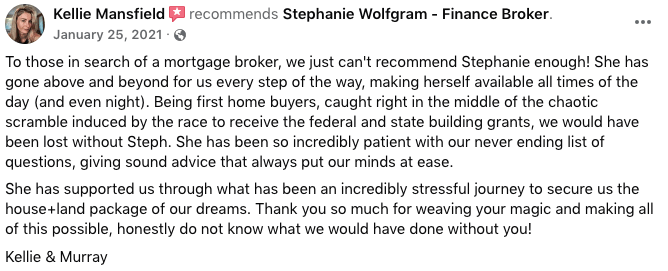

Need a Home Loan? What Our Fabulous Clients Think About Us!

Samantha Buck

Matthew Walsh

Sophie Papamarkos

Jess McCormack

Darryl Johnson

Tessa Lim Tayag

Susie D Wells

Bronte Holmes

Annabel Katherine

Wayne Curtis

Irvin Calica

Karen Dao

Kellie Mansfield

Curtis Vittorangeli

Jo Marie Minney

Kyle Spyrides

Sharon Gleeson

Samantha Dunn